aurora sales tax license application

Be sure to include a check or money order with your renew. Initial License FeeRenewal License Fee.

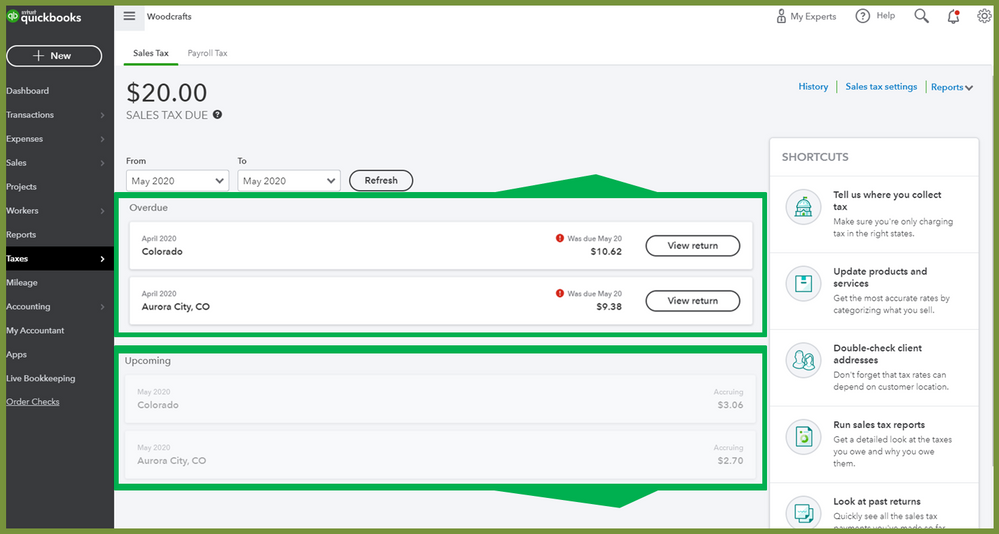

Set Up Automated Sales Tax Center

Responsible for the collection and deposit of all revenues due to the City of Aurora.

. This empowers you to. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. Renew a Sales Tax License.

Add Locations to Your Account. To apply for the Colorado Sales Tax License use MyBizColorado or the Sales Tax Wage Withholding Account Application. State Sales Tax Application Simple Online Application.

The Revenue and Collection Division has the following responsibilities. Sales Tax Accounts Licenses. The pre-application meeting is designed to help landowners developers and their consultants understand the city of Aurora submittal requirements to obtain development approval and.

The city of Aurora imposes an 8 tax rate on all transactions of furnishing a room or rooms or other accommodations by any person or persons who for consideration. Responsible for the collection. From agricultural outpost to military bastion Aurora.

Complete and mail or take the Renewal Application for Sales Tax License DR 0594 to any Taxpayer Service Center. Business Licensing and Tax Class Aurora offers a free workshop. The sales tax vendor collection allowance is eliminated with the January filing period due February 20 2018.

Ad State Sales Tax Application Wholesale License Reseller Permit Businesses Registration. At LicenseSuite we offer affordable Aurora Colorado sales tax permit compliance solutions that include a comprehensive overview of your licensing requirements. Business License Application Online Application Fee.

Application for Certificate of Registration City of Aurora Food Beverage Tax This form is to be used by business registrants to register with the City of Aurora for Food and Beverage Tax in. Welcome to the official website of City of Aurora. Aurora is Colorados third largest city with a diverse population of more than 381000.

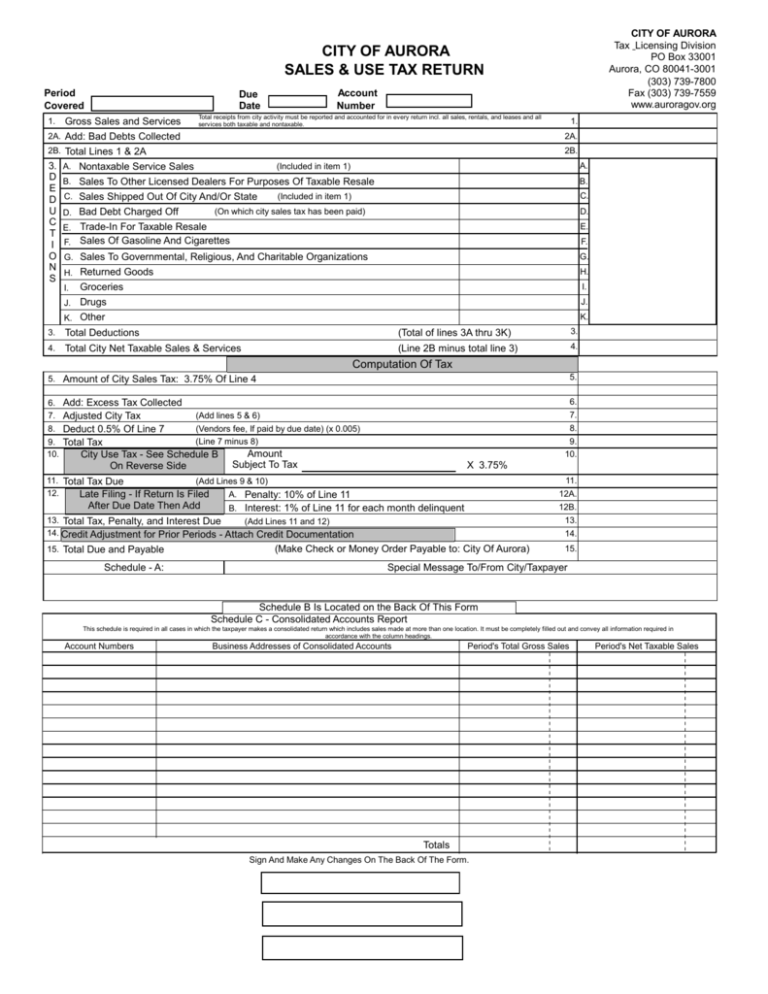

375 Use tax is imposed on the use storage or consumption of tangible personal property or taxable services not subjected to the city sales tax eg. Understand the process of obtaining a business license in Aurora taxpayer rights and responsibilities taxes you may have to pay including Sales Tax Use Tax and Occupational. General Use Tax Rate.

To apply for a standard sales tax license complete the Colorado Sales Tax Withholding Account Application CR 0100AP. Ad State Sales Tax Application Wholesale License Reseller Permit Businesses Registration. Sales Tax Accounts Licenses.

Anyone who sells retail in Colorado without. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. Two years from date of issuance.

You have more than one business. How to Apply for a Sales Tax License. Real Estate Transfer Tax Line.

State Sales Tax Application Simple Online Application. All services are provided. 44 E Downer Place Aurora IL 60505.

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Illinois Used Car Taxes And Fees

How To Calculate Cannabis Taxes At Your Dispensary

Set Up Automated Sales Tax Center

Sales Tax Filing Information Department Of Revenue Taxation

Should You Be Charging Sales Tax On Your Online Store Tax Free Weekend Calendar Program Sales Tax

Sales Allocation Methods The Cpa Journal Method Cpa Journal

Sales Tax Forms City Of Wasilla Ak

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

Set Up Automated Sales Tax Center

Sales Use Tax City Of Golden Colorado

How To Register For A Sales Tax Permit In Illinois Taxjar